|

BARCLAYS BANK

|

|||||||||||||||||||||||||||||||||

|

HOME | CASE STUDIES | LAW | NEWS | POLITICS | RIGHTS | SCANDAL | SITE INDEX | WHISTLEBLOWING |

|||||||||||||||||||||||||||||||||

|

SIZE MATTERS - That is the size of my salary and that is all that matters, the little man can take a hike. Frankly, we don't care so long as our shareholders appetite for profits is satiated long enough for us to cream off some of the pie.

TELEGRAPH 30 JANUARY 2016

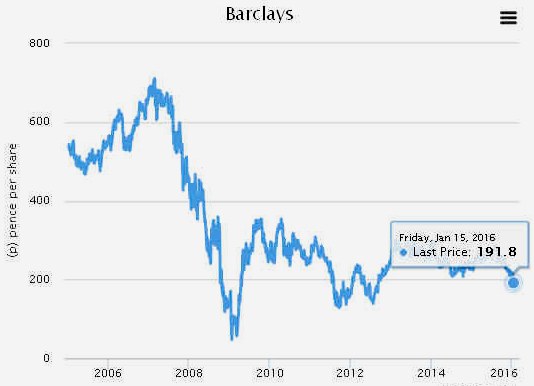

Barclays shares have tumbled almost 20pc within the past month, but this doesn't look like a buying opportunity, says Questor.

JOHN

MCFARLANE - Laughing all the way to the bank. He earned the nickname with his promise to ensure ethics returned to banking when he replaced Bob Diamond as chief executive in 2012, and he has done much to change the culture at

Barclays - except concerning re-opening accounts that were closed despite

a customers specific instructions not to close. This was because the

account was not making money for the bank at the time.

STREAMLINING

FOR THE FUTURE

DEFINITION

Building societies are owned by their members for the benefit of both saving and borrowing members. But building societies have been merging, have been taken over by banks and have turned themselves into banks. This study looks at what is taking place, and why.

It is one of a series of eight studies of co-operatives and mutual societies which were undertaken to determine causes of failure and reasons for success, to see how these enterprises were controlled and managed, to learn from the mistakes of others. What is taking place is fascinating and often unexpected.

The main report 'Co-operatives: Causes of Failure, Guidelines for Success' is based on these studies. Its conclusions and recommendations are entirely relevant and cover fundamental and practical problems of co-ops and mutual societies, of members, of direction, management and control.

Barclays Stockbrokers, is a UK retail stockbroker offering a range of dealing accounts; online and by telephone.

Key Features

WHO

IS JAMES STALEY - James Staley, 59, is a former chief executive of JP Morgan Chase's investment bank. He spent more than 30 years of his career there before joining hedge fund BlueMountain Capital Management in 2013.

The case below may be of interest to investors who may like to know how other customers have been treated . If you have had a similar experience, why not email us for inclusion or possibly for onward transmission to the Banking Ombudsman.

Barclays Bank PLC is a member of the Financial Services Compensation Scheme established under the Financial Services and Markets Act 2000. In respect of deposits with a UK office, payments under the Scheme are limited to 100% of the first £2,000 of a depositor's total deposits with the bank and 90% of the next £33,000, resulting in a maximum payment of £31,700. Most depositors, including individuals and small firms, are covered. The Scheme covers deposits made with the offices of the bank within the european economic area and deposits denominated in all currencies are treated alike. Further details of the Scheme are available on request from The Woolwich by calling 0800 400 900. This Scheme is not applicable to branches in the Channel Islands or the Isle of Man.

"The Woolwich" and "Woolwich" are trading names of Barclays Bank PLC, which is authorised and regulated by the Financial Services Authority. Barclays Bank PLC. Registered in England. Registered No: 1026167. Registered Office: 1 Churchill Place, London E14 5HP.

BUILDING SOCIETIES HISTORY

The first building societies were formed about 200 years ago when some people got together to co-operate with each other in building their own houses. Members regularly contributed to the society and built the houses together. Each completed house was allocated by lottery to a member. They carried on until each member had his own house. The society, the house-building co-operative, was then dissolved.

After a while building societies began to borrow money from investors to build houses more quickly and this was the start of permanent building societies, now simply called building societies. Then about 100 years ago, most UK building societies stopped building houses and concentrated on providing capital for building houses, on providing mortgages.

Building societies are mutual societies, are owned by their members for the benefit of members, that is of both savers and borrowers alike.

Many people are tied for life to paying rent to, and so working for, profit-seeking landlords who are able to increase rents largely at will and who are thus absorbing any gains in income. The building society movement, however, has enabled a massive number of people in the UK to own their own homes. It has been giving people something to work for and a sense of achievement from living in a house of one's own, enabling them also to save and provide for retirement and old age.

In the UK at this time are 80 building societies with 5,500 branches, having between them something like 30 million accounts (savers and borrowers) and assets of GBP 262 billion. Their net profits of GBP 1 billion amount to a net profit per account of GBP 35.

UK legislation regulates what building societies may, or may not, do. When banks started to offer mortgages, building societies were enabled by legislation to compete with banks by providing personal loans and other financial services such as current accounts. But building societies have been merging, been taken over by banks and have turned themselves into banks. Their number is reducing and branches are being closed down. So here in this study we take a close look at what is happening by means of case-studies and draw some relevant conclusions.

RESERVES AND OWNERSHIP

While banks concentrate on maximising rewards for directors and profits for shareholders, a building society provides a service to its members. Building societies, however, have retained surplus funds and over the years built up massive reserves. Over 150 years, for example, UK building societies built up GBP 14.3 billion of reserves. There is much concern that this is being dissipated by conversions and takeovers.

Reserves increased to GBP 16 billion during 1994/95 and the Building Societies Commission in its annual report re-emphasised the need for societies to explore ways of distributing excess capital to members. While some societies have launched loyalty bonus schemes, others are considering paying a regular dividend, by issuing some form of share.

Maria Scott, writing in the Observer, said Building societies generally pay better returns than banks. But is the difference enough? Building society directors have paid lip-service to the ideals of mutuality for years. Even now, under siege from aggressive outsiders, none has come up with a way to release their substantial accumulated profits to members that would mark them out from High Street banks. Instead, they cut savings rates at the first opportunity.

A public company would, typically, pay half its post-tax profits to shareholders in dividends. If societies chose this measure, customers could expect somewhere between GBP 15 and 20 per account each year. However, building societies are not expected to follow this model and most argue that any annual dividend-style distribution would fail to impress customers. Instead, they are working on schemes such as that announced by Bradford and Bingley last week that will pay sums running into hundreds of pounds but only if the investor keeps the account open for a few years.

CONCLUSIONS

What has been and is taking place seems to be as follows:

BUILDING SOCIETIES AND BANKS

Banks concentrate on maximising rewards for directors and profits for shareholders.

A building society is a mutual society owned by its members. Both depositors (lenders) and borrowers are members. The mutual interest between lenders and borrowers is that profits are shared out between them. Compared with banks, the lender gets more and the borrower pays less.

Building societies have been retaining some of their surpluses and over 150 years have built up massive reserves.

A mutual society is run for the benefit of its members and its reserves were accumulated for the purpose of better serving its members and the community. And so building societies became big, influential and powerful.

This book is about a building that is in dire need of conservation work. A charity that is doing its best to shore up the roof and walls planned to publish this volume to generate funds for the restoration effort.

At present (Feb 2016), Barclays Bank is holding up publication. They closed an account without consent and took the money in that account, with no provision to give that money back. In our book, that constitutes fraud. Both Jes Staley and John McFarlane know what their bank has been up to, but so far have not made any reasonable effort to help the charity concerned back to where they were before the breach of contract/discrimination.

LINKS

Telegraph UK finance news Barclays Telegraph UK finance Questor share tip Barclays shares look like a value trap http://shares.telegraph.co.uk/fundamentals/?epic=BARC http://www.telegraph.co.uk/finance/12130839/Questor-share-tip-Barclays-shares-look-like-a-value-trap.html http://www.telegraph.co.uk/finance/newsbysector/epic/barc/ Standard UK business news Barclays chairman John Mcfarlane

WE ACCEPT NO RESPONSIBILITY FOR THE ACCURACY OF ANY FEATURED LINKS

|

|||||||||||||||||||||||||||||||||

|

IF YOU HAVE ANY GOOD STORIES TO TELL WE'D LIKE TO HEAR FROM YOU. WHY NOT BUILD A WEBSITE OF YOUR OWN TO TELL OF PROBLEMS IN YOUR AREA - IT'S YOUR RIGHT. WE WILL LINK TO YOUR SITE WITH A SHORT SUMMARY.

With thanks to Action Groups around the world for the supply of real case history and supporting documents.

|

|||||||||||||||||||||||||||||||||