|

OLIVER BUTTERWORTH

HOME | CASE STUDIES | HISTORY | HUMAN RIGHTS | LAW | POLICE | POLITICS | RIGHTS | SHIT CREEK | SITE INDEX |

||||||||||||||||||||||||||||||||||||||||||||

|

According to his Linkedin profile, Oliver Butterworth is a crime prevention specialist. On this page you can see what that means. We were under the impression that you had to be guilty of a crime to be punished as is a Human Right under Article 6. Not according to some of the leading British banks. They play God and nobody seems to be able to stop them. Perhaps they've been watching too much Minority Report. They say power corrupts, and here is your proof. We are of course willing to accept and print any explanation the Lloyds, HSBC or Barclays would care to offer.

An account at Lloyds bank in Eastbourne was opened by a company that wished to trade not for profit, aiming to complete research helpful in the fight against pollution. The senior business manager who finally opened the account was Mrs Joanne Collins. The process was begun in May of 2016. It took from May until 14 June before the account could be used. The delays cost the company major issues where a grant had to be used within 12 months. The near two month delay was crippling. Meaning that additional effort needed to be put into purchasing to try and make up for lost time, and some work done by the company could not be billed for - causing loss.

More than a month into the process Ms Collins requested additional signatures from two companies that were directors in addition to the signatures and proofs of ID of the people directors. This information could have been requested weeks earlier when the directors attended in person at the Eastbourne branch: "I require the attached forms to be signed by a director from each of these companies." Hence, Lloyds, knew about the other directors at the inception of the account. They could thus have warned the company if there was anything that might need attention or explaining. If they had done so, any issue could have been cleared up, or if Lloyds were still unhappy, another bank could have been approached, to avoid any issues in the future.

Finally the account was up and running and all was well, until August of 2017. This was when Oliver Butterworth came onto the scene with a recorded delivery letter claiming that Lloyds could not reach the company by telephone, when that would have been impossible - because the phone was manned during office hours. In other words it was a ploy. The same telephone ploy was used by HSBC. We do not think this is a coincidence, because later in 2017, Wealden chimed in with similar questions about the same premises. Then later still, HSBC chimed in with a very similar set of questions about one of the companies that was a director. The companies that were directors opted to resign their directorships, but still Oliver pressed home his attack with the ruthless precision of the Gestapo officer in Inglourious Bastuerds - the Quentin Tarantino film depicting the Jew hunter in occupied France.

At this point the company has ceased trading, having exhausted funds and achieved it's research obligations. Lloyds were no longer gaining interest, so pressed home their attack. Mr Butterworth had drawn up a list of questions that he already knew the answers to. Hence, this was another ploy aimed at entrapment - or maybe just an excuse to cause expense and frustration in the hope the account would be closed. Who knows, but clearly, from wording in the correspondence, this chap enjoyed his job. We feel, getting a kick out of causing distress. We feel that a lot of guards at concentration camps also got a kick out of throwing the weight about.

Oliver's excuse for asking about shares was to ascertain if anyone owned more than 10% or more of the capital profits of voting rights. But Oliver could see that there had been no dividends and also knew from the number of shares issued, less than 2% in total, that nobody could have 10% - that is unless he was unfamiliar with company law and/or had not checked at Companies House to see the share structure of the company.

On the 12th of October 2017 the company supplied copies of the share certificates issued, proving the situation. These were sent by recorded post to Westminster House in Manchester. Oliver was told that the company was a non trading entity engaged in environmental research.

Despite considerable correspondence explaining to Butterworth that his machinations were figments of his imagination, he would not listen to reason, even though, if he'd investigated the matter properly, he had no case. We must assume therefore that he had an alternative agenda.

The account was closed in November of 2018.

This appears then not to be an isolated incident, it fits in with a pattern that began in 1997 with a Petition to Wealden District Council and lodging of a complaint with Sussex police. We feel sure that all would have been well had Nelson Kruschandl not pursued Sussex police, Derek Holness and the follow on chief executives and constables of these local authorities.

We appreciate that anti-money laundering and the funding of terrorism has to be a number one priority in what is a cyber war, but misuse of authority is the hallmark of many civil servants and bank employees.

INDEPENDENT 6 FEB 2016 - David Mills, centre, and his colleague Michael Bancroft, left, Lynden Scourfield, right (

Thames Valley Police )

LLOYDS BANKING GROUP

If you think the above is complicated and worth investigation, take a look at the Lloyds Banking Group:

Lloyds Banking Group plc. Registered Office: The Mound, Edinburgh EH1 1YZ. Registered in Scotland no. SC95000. Telephone: 0131 225 4555. Lloyds Bank plc. Registered Office: 25 Gresham Street, London EC2V 7HN. Registered in England and Wales no. 2065. Telephone 0207626 1500. Bank of Scotland plc. Registered Office: The Mound, Edinburgh EH1 1YZ. Registered in Scotland no. SC327000. Telephone: 03457 801 801. Cheltenham & Gloucester plc. Registered Office: Barnett Way, Gloucester GL4 3RL. Registered in England and Wales 2299428. Telephone: 0345 603 1637

In the words of John McEnro: "you cannot be serious." Pass the parcel is a game we played as children. The police have engineered a system where a member of the public who reports a crime, may be given the run around until they run out of steam. The police in this country are not investigated for the crimes they refuse to investigate - hence, we do not have an effective police force. No wonder Article 13 in missing from our Human Rights Act 1998.

HSBC & BARCLAYS

The Eastbourne branch of the Hong Kong Shanghai Bank held an account for a fledgling soft drinks company for many years without any issues. Things changed when one of their customers staged a fight with Wealden District Council, asking Sussex Police to investigate what appeared to be organised malfeasance in public office, a serious crime for which the maximum penalty is life imprisonment. Sussex police did not investigate, faking an investigation and subsequent false report to the council's full committee, about which the police became party to the malfeasance.

The police failings happened some years before HSBC got involved, using anti-money laundering statute to ask questions that appear to be similar in format and to target one individual - the person who was making waves for Sussex police and the planning officers and chief executives of Wealden District Council. Is that just an unbelievable coincidence?

Little was the victim of what appears to be a conspiracy to know, but there was a masonic link lurking in the background in the form of the assistant district planning officer and his father in law, Bernard Best, and a councillor who belonged to the Tyrian Lodge in South Street, just around the corner from the police station in Grove Road.

The pattern of questions were first identified in a Contravention Notice served by Wealden on their target and other organisations with an interest in 2017. Later, Lloyds Bank asked a similar series of questions, once again targeting the same individual about shares that he did not own. Then HSBC joined in with Peter McIntyre and Laura Gaughan asking more questions with the same target in the mix. The branch concerned is/was at: 94 Terminus Road, Eastbourne, BN21 3ND.

Prior to this Barclays bank has closed an account in what looks to be part of the same state sanctioned agenda, in a lesser form. But nevertheless an account was closed despite protestations as to loss. It remains to be seen if there is any other connection or common denominator. At the moment it all points one way.

The objective appears to be to cause a lot of work for the individual and any concern that he worked for, ultimately to force the closure of accounts - and so prevent their target from making money or having any chance of being successful. You might care to agree that banks are supposed to be supportive of entrepreneurs, not do their best to put them out of business.

At first Laura Gaughan tried to interrogate the director of this company over the telephone. Before this conversation (that was recorded as evidence) there was a recorded delivery letter saying to phone to make an appointment to visit the branch. That was misleading to say the least. Laura did not want an appointment to talk about things at the local branch, she only wanted to fire a series of questions at the director that were designed to get the director to incriminate herself, without giving any indication as to what the subject matter was so as to allow the director to refer to the files for accuracy. Talk about human rights violations. Has Laura not heard of a person's miranda rights. Or, in this country, the right to remain silent as per Article 6. But more importantly, the right to know what is being leveled at her, before saying anything that may be misconstrued.

When the company director realised it was a stitch up, she asked for the questions in writing. Sure enough, there came a long list of questions aimed at Mr Nelson Kruschandl, even mentioning him by name. The pattern is, as we say, remarkably similar in format, qualifying as institutionalised discrimination when coupled to the behaviour of Barclays and Lloyds banks - and of course, Wealden District Council under the leadership of Charles Lant, now Trevor Scott.

The account expenditures were small purchases that any business would make and others essential to the cause, in this case supporting a charity with free administration services.

The soft drinks company wrote back to Laura Gaughan asking for clarification of issues, also providing copy of Wealden's contravention notice and other planning related documents that proved the the district council had lied to the Secretary of State in 1987 and 1997. Ms Gaughan failed to respond to the request for information and ignoring the letter from the soft drinks company, Peter McIntyre gave notice that the account would be closed.

HSBC could not respond to the questions being asked, or admit to conspiracy to pervert the course of justice, or worse.

Following this, a director of the soft drinks company attended the Eastbourne branch to ask why the company's correspondence had been ignored, when the account manager, Tim Austin, tried to explain that all customers were being asked similar questions. Mr Austin made it plain that he was not privy to the correspondence, hence could not comment on the letter of complaint.

The complainant makes no bones about Mr Austin, who had been helpful in the operation of this account over the years. His reply though was near identical to Ms Gaughan's when she was asked why the HSBC were asking a similar set of questions to that Wealden and Lloyds bank had been asking. Ms Gaughan also said all customers were being asked the same questions. But that could not possibly be true. Indeed, the level of research and coordination is suggestive of a dedicated witch hunt, all aimed at destroying the victim.

On the other hand, if all customers are being asked the same questions with a specific target, then are our banks now turning into a kind of Gestapo service for Her Majesty Queen Elizabeth?

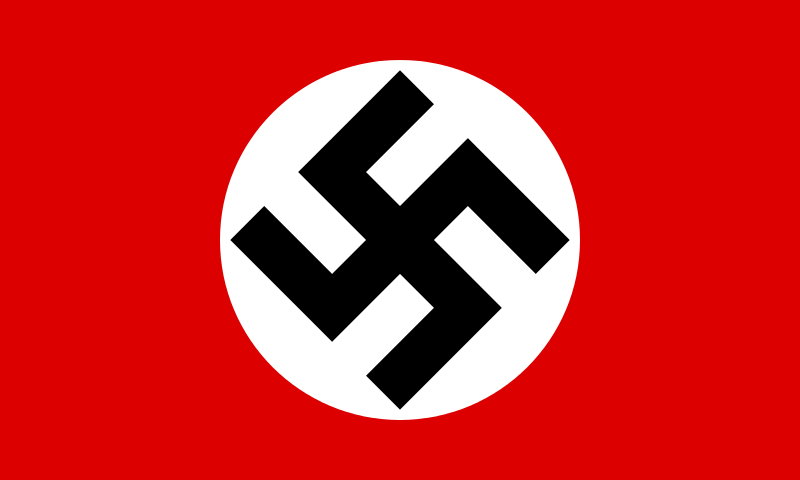

Council civil servants are only one step removed from Nazi Gestapo officers, but think exactly like the brown shirts that led to World War Two. The planning system is particularly prone to breeding workers who develop a power complex and seem to take delight in what the ordinary man in the street would term sadistic practices.

The United Kingdom has laws that oppose the concept of a level playing field, allowing the police, councils and banks to target individuals and to hound them is such a manner as to prevent them from succeeding in the commercial world. For example, their names are flagged up on banking computers, whereupon the customer is given short shrift and shown the door. Hence, the victim cannot compete in the commercial world. Given that everyone should have the right to make a living on equal terms, this agenda appears to have all the hallmarks of some kind of secret society Fourth Reich in the making.

If the allegations are true, this is discrimination plain and simple. The kind of discrimination that led to the extermination of millions of Polish and Jewish people in the Second World War, after Adolf Hitler took his empire building and supposed ethnic cleansing programmes to new industrial heights with the Concentration Camps that are his legacy.

The Gestapo were enlisted to round up undesirables and herd them into the death camps to do forced labour until they either died of malnutrition or were put into the gas chambers to be exterminated using Zyklon B or even just the exhaust fumes from motor vehicles.

We wonder if this is a new era of Nazism in a new form. Clearly, if this kind of targeting of individuals is taking place by way of an undercurrent of activities by the state aimed at disadvantaging certain people, Article 14 is being violated along with many other Human Rights conventions adopted by the United Nations by way of the Universal Declaration.

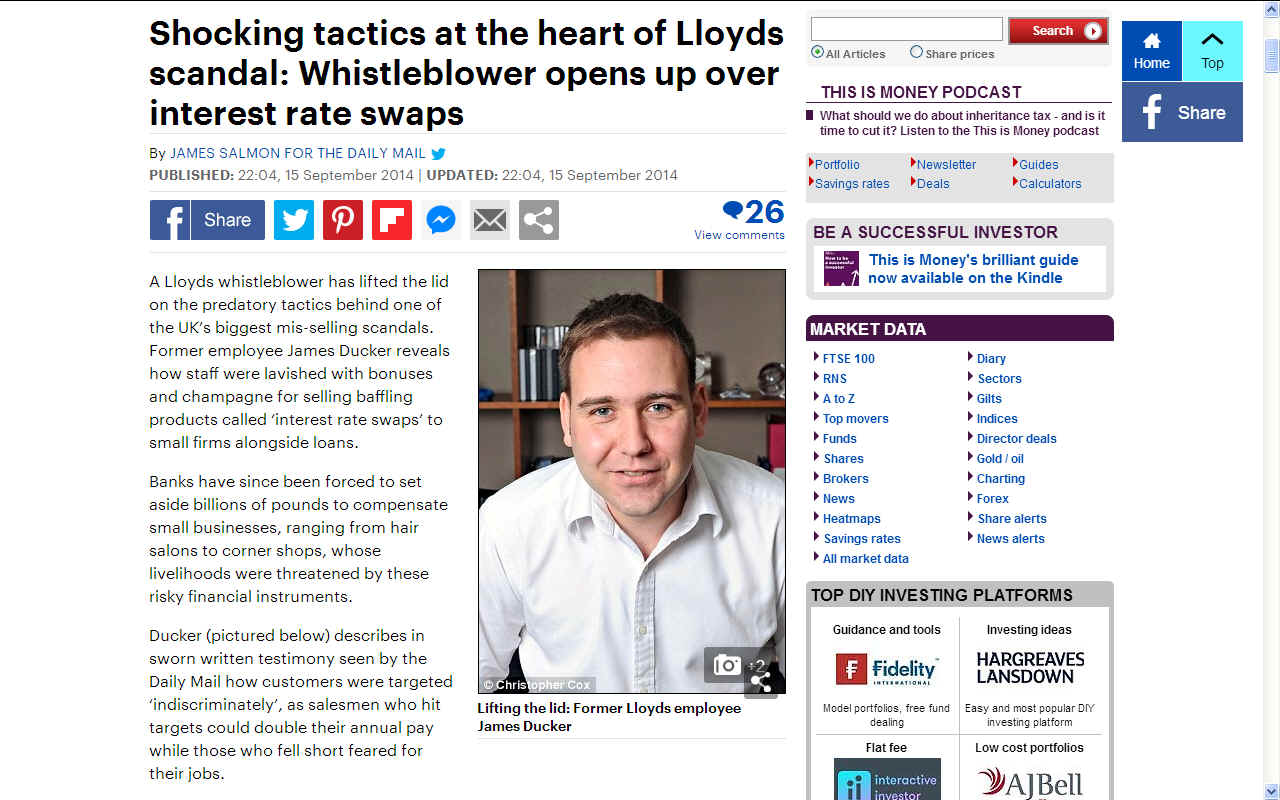

We await hearing from the HSBC and/or any of their employees (in confidence) should any member of their staff wish to Blow the Whistle.

THIS

IS MONEY 15 SEPTEMBER 2014 - Lloyds whistleblower has lifted the lid on the predatory tactics behind one of the UK’s biggest mis-selling scandals. Former employee James Ducker reveals how staff were lavished with bonuses and champagne for selling baffling products called ‘interest rate swaps’ to small firms alongside loans.

ABOUT OLIVER BUTTERWORTH

According to his Linkedin account, Oliver Butterworth is an AML/ Financial Crime Prevention Specialist (CDD/KYC) at Lloyds Banking Group, Bolton, United Kingdom.

Oliver professes to be an experienced leader with comprehensive operational knowledge and effective leadership skills. Oliver is commercially aware with significant experience across a number of roles and sectors within the Financial Industry. With a strong track record he is highly successful in driving efficiencies, that we take to mean forcing private information out of people and shutting down small enterprises. We await confirmation from Oliver as to just how many small businesses he has caused upset? Maybe it is time for him to blow the whistle as to these banking practices. Or, maybe other company directors reading this might care to share any information they have on Mr Butterworth and the Lloyds banking group. There should be quite a few as he has been with the Lloyds Banking Group for 8 years at the time of writing.

Experience

Oliver's role in the Automated Portfolio Management (APM) Development team is to provide Thought Leadership and Subject Matter Expert input to Business Unit and Risk stakeholders in order to analyse, define, shape, communicate & validate requirements for proposed enhancements to LBG owned applications with a focus on real-time monitoring of AML/ FCP triggers and CDD Standards (KYC/ OKYC).

Oliver will also lead business improvements, understanding business problems and opportunities in the context of the requirements. This includes providing thought leadership to support opportunities as a result of industry and regulatory changes, working with other LBG.

Title Centre Manager, Ongoing Due Diligence (AML/KYC)

Title Business Performance Manager, PPI Operations, Leeds

Title Service Manager - Online Helpdesk

Title Operations Manager - ISA Transfers

WHO WE WERE FIGHTING AGAINST FROM 1939 TO 1945

WEALDEN'S OFFICERS FROM 1983 TO 2018

Abbott Trevor - Alcock Charmain - Ditto - Arnold Chris (Christine) - Barakchizadeh Lesley - Paul Barker - Bending Christopher Black Julian - Boakes Beverley - Bradshaw Clifford - Brigginshaw Marina - Brown Ashley - Coffey Patrick - Douglas Sheelagh Dowsett Timothy - Flemming Mike - Forder Ralph - Garrett Martyn - Goodwin Daniel - Henham J - Holness Derek Hoy Thomas - Johnson Geoff - Kavanagh Geoff - Kay Ian - Kay I. M. - Barbara Kingsford - Lant Charles - Mercer Richard Mileman Niall - Moon Craig - Moss Douglas, J. - Nuttall Christine - Pettigrew Rex - Phillips David - Scarpa Victorio - Scott Trevor Kevin Stewart - Turner Claire - Wakeford Michael. - Whibley David - White, George - Williams Kelvin - Wilson Kenneth - White Steve

The SS and SA were the special forces used for political purposes. At this rate it will not be long before all councils in Britain are run by civil servants who think like Gestapo officers. They might as well cut out the pretence and wear brown shirts and long black boots. Heil Hitler! Banks are following suit, targeting individuals and companies where there is nothing sinister, but simply because they are out to get a particular person. They have been given positions of trust and powers that if abused are sure to cause their victims loss, as per Section 4 of the Fraud Act 2006.

LINKS & REFERENCE

https://www.thisismoney.co.uk/money/markets/article-2756776/Shocking-tactics-heart-Lloyds-Banking-Group-scandal.html https://www.linkedin.com/in/oliver-butterworth-95b0a236/ https://www.birminghammail.co.uk/news/midlands-news/council-binmen-like-gestapo-former-7061110 http://www.dailymail.co.uk/news/article-1365235/Chelmsford-Council-rubbish-gestapo-fine-nurse-75-black-bag-wheelie-bin.html

UNIVERSAL DECLARATION OF HUMAN RIGHTS

EUROPEAN CONVENTION OF HUMAN RIGHTS

|

||||||||||||||||||||||||||||||||||||||||||||

|

This site is free of © Copyright except where specifically stated 1997 - 2021. Any person may download, use and quote any reference or any link, and is guaranteed such right to freedom of information and speech under the Human Rights and Freedom of Information Acts. However, be aware that we cannot be held liable for the accuracy of the information provided. All users should therefore research matters for themselves and seek their own legal advice and this information is provided simply by way of a guide. Horse Sanctuary Trust UK All trademarks herby acknowledged.

This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. FAIR USE NOTICE

|